Last year was a forgettable year for Vietnam’s banking system. In the first half of the year, banks ran out of credit room, making many banks unable to lend in the second half of the year. The application of a credit room is too harsh a policy of the State Bank of Vietnam. Last year, a series of banks received deposits from customers, but could not lend, due to credit room limit. Therefore, many banks directed the cash flow of customers to the bond market, and as a result, customers are empty-handed.

Last year, the Communist government of Vietnam announced that the inflation figure was always below the threshold of 4%, however, paradoxically, the State Bank of Vietnam (SBV) tightened the credit room. Because, the SBV uses the policy of imposing a credit room for the purpose of fighting inflation. Thus, with the low inflation as they announced but using a very strong anti-inflation policy, it shows that the inflation rate they announced is not correct. In fact, prices have escalated between 10% and 20%.

Cash flow is the lifeblood of the economy and businesses. The tightening of the credit room to control inflation but caused many other consequences. Many capital-starved enterprises have to be dissolved in mass, leading to unemployment, growth decline and many other consequences. In fact, last year, the economy was very bleak, many businesses had to close since September and laid off a lot of employees.

That’s what happened last year, this year, everything is still the same. The problems of the banking and finance industry, if not completely resolved, will affect the whole economy. According to Sputniks, the Vietnamese banking industry started to take a hit. Currently, low credit demand, increased input costs, difficult to increase credit fee income, and high risk of bad debt put pressure on risk provisions, causing the profit of many Vietnamese banks to decline. in the first half of 2023.

It is known that since the beginning of the year, 113,000 businesses have left the market. When businesses cannot survive and they are forced to dissolve, of course, the need for credit also decreases. Business and banking as two sides of the economy. If the banks are in crisis, the business will die, and if the business fails, the bank will also suffer.

Pham Chi Lan, an economic expert, once said that world economic experts assessed that Vietnam is a country that “doesn’t” develop, not “underdeveloped.”

This saying is very accurate, because if a country is less developed, there is still room for development, albeit slowly. But Vietnam refuses to develop, which means there is no chance, in addition, Vietnam chooses the wrong political and economic model. Only when they bring the whole people to the end, with no food left, will they correct their mistakes. However, this correction is still only half-hearted, because the Vietnamese economy is still being controlled by the Communist Party in a will-only way.

The growth figures of the Vietnamese economy are unreliable. However, even if it is true statistics and gives real numbers, it still does not reflect the true nature, because the strength of the Vietnamese economy is standing on three pillars, which are state-owned enterprises. private enterprises and foreign-invested enterprises (FDI). In particular, the role of the FDI sector is increasing. It can be said that the Vietnamese economy is standing on three pillars, then all two legs are lame, only one leg is temporarily strong, which is FDI.

Of those two cripples, state-owned enterprises are favored, while private enterprises suffer all kinds of hardships. In difficult economic times, businesses need loans to overcome difficulties, but banks are not healthy, then try to ask, how can the private sector survive. Therefore, from the beginning of the year up to now, there have been 113,000 enterprises bankrupted. This is an inevitable consequence of the weak management of monetary policy by the State Bank of Vietnam.

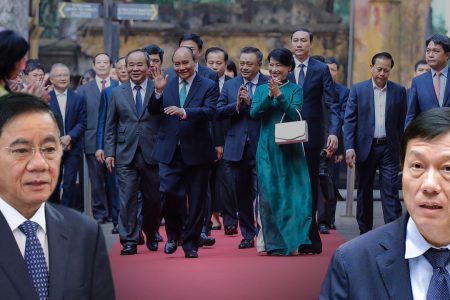

In the Government, there is a matching pair, the weak and the weak. Those are the monetary policy managers and the fiscal policy managers – SBV Governor Nguyen Thi Hong and Prime Minister Pham Minh Chinh.

Monetary policy is really bad, last year the banks were in tatters, this year the banks are in tatters. How does PM Chinh manage to let the business die like a stubble? The Chinh-Hong couple, a couple who are crushing the economy together.

Thoibao.de (Translated)